Construction Survey

FOOD ENGINEERING’s 46th Annual Plant Construction Survey

July 14, 2023

Construction Survey

FOOD ENGINEERING’s 46th Annual Plant Construction Survey

July 14, 2023A M King designed and built Mission Produce’s avocado ripening and processing facility in Laredo, Texas. Photo courtesy of A M King

If you’ve ever played “Whac-A-Mole” on the boardwalk or at an arcade, you can get a sense of the frustration that both food and beverage processors and architecture/engineering/construction (AEC) firms are feeling in today’s economy—fix one problem, another pops up. Though the effects of the COVID-19 pandemic are sinking from view, the havoc that the pandemic wreaked with the supply chain and the economy is popping up in both expected and unexpected ways. We expected a slow recovery from the pandemic—especially with supply chain issues and the economy, but for some AEC firms, unexpected surprises either slowed projects or opened new projects.

| Top 10 AEC Hot Trends | |

|---|---|

| Key Trends/Issues | |

| 1* | Fast project deployment |

| 2* | Scheduling equipment arrival to job site |

| 3 | Capital availability |

| 4 | Food safety: FSMA regulations/GFSI (design. layout, etc. |

| 5 | Overall cost/controlling costs |

| 6* | Ability to easily manage subcontractors |

| 7* | Automation: process control, packaging, AI/ML, etc. |

| 8 | On-site wastewater treatment/energy recovery system< |

| 9 | Workforce availability (tech staff) |

| 10* | LEED and/or sustainability-related design principles |

| 10* | Utilities: Electricity, natural gas, oil, etc. |

| 10* | Workplace safety |

| * Indicates tie | |

To see what issues are trending this year, we asked A&E/Cs what are the ten hot trends affecting them as they manage projects (see “Top 10 AEC Hot Trends”), and we also asked them to list what they see as the ten issues of most concern to their food and beverage processor clients (see “Top 10 Trends AEC Firms Say Are Of Most Concern to Food Processors”). The first three items on both lists definitely show effects of the pandemic and stagnating economy, and include concerns for capital availability, controlling costs, scheduling equipment for a project and getting projects deployed in a timely manner—and having workers available both for the project itself and to operate a food facility.

| Top 10 Trends AEC Firms Say Are Of Most Concern to Food Processors | |

|---|---|

| Key Trends/Issues | |

| 1 | Workforce availability (line workers) |

| 2 | Overall cost/controlling costs |

| 3* | Capital availability |

| 4* | Fast project deployment |

| 5 | Automation: process control, packaging, AI/ML, etc. |

| 6 | Increasing production to meet demand |

| 7 | Site location related to transportation, logistics, utilities |

| 8 | Workplace safety |

| 9 | Flexibility in plant design to accommodate flexible manufacturing |

| 10* | LEED and/or sustainability-related design principles |

| 10 | Food safety: FSMA regulations/GFSI (design. layout, etc.) |

| * Indicates tie | |

Expected Effects of COVID-19 Linger On

“The COVID-19 pandemic is behind us, but the lingering effects still remain,” says Brad Barke, president/founder of ESI Group USA. “Costs and lead times of certain materials have driven building costs to much higher levels. The facility modifications made because of COVID are now more standard with new or renovated facilities. The administration’s attempt to curb inflation has caused owners to rethink new facilities and additions as the fear of inflation and a slowdown in the economy remain very real.”

“The high inflation experienced under the Biden Administration has caused drastic increases to the cost of most goods and services,” says David Sawicki, A M King business unit leader. “These cost escalations and subsequent attempts to control inflation are straining access to capital and making CapEx projects more challenging to get approved.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

“We are seeing projects placed on hold due to looming recession,” says Ronald L. Rens, president, Gleeson Constructors & Engineers, LLC. “Capital projects are decreasing due to lower demand and margins caused by inflated costs and tight supply chains. Owners are delaying projects as they seek funding or grants. Projects are taking much longer to start and durations are extended based on availability of equipment and materials.”

Some food processors are feeling the brunt of our weakened economy. “Elevated inflation has led to decreased unit sales, which in turn have led to decreased production demand overall,” says Tony Moses, CRB fellow, director of product innovation. “So, [food] companies are sizing their facilities accordingly or choosing to delay some projects. With the tight labor markets, we see companies being more deliberate about facility location and the degree of automation. We’re also seeing opportunities with contract manufacturers, as more consumers turn to private labels, and some companies delay investment decisions.” (For site location pointers, see “Site selection criteria.”)

Not all news is entirely negative. Despite the inflation issues, the demand for construction projects in the food and beverage sector is still strong, says Nate Larose, CMC Design-Build director of project development. But he wonders what the next couple of years could bring. “Higher interest rates and concerns about how the overall economy will fare are worrisome to many.” In spite of this, Larose sees an unexpected, brighter side to the situation. The weakening of the economy has led to some softening in the real estate market and in the cost of construction materials, which are helping to offset the higher interest rates.

Though costs of construction have risen due to inflation, smaller projects still succeed. “We continue to see an increase in the number of entrepreneurs who approach us wanting to develop small processing plants for local distribution,” says Mark Redmond, president of Food Plant Engineering LLC. “We are frequently approached by meat processors seeking to expand their current operations.”

The Unexpected: Bad and Good

Finding labor has been a problem for some time, but who would have expected that the government’s funding of public projects would create a problem for food and beverage construction? “With the Biden administration’s recent actions to spur spending on infrastructure, biotechnology and biomanufacturing, there is high demand for construction materials and especially labor,” says David Ziskind, Black & Veatch director, food & manufacturing solutions. “Food and beverage clients are taking advantage of opportunities as funding becomes available, but also find themselves in the position of competing against other construction projects for labor. While the Administration’s actions provided for funding, there is still work to do in developing additional construction labor for this demand.”

While U.S. markets seem to be slowing, there may be more activity globally, according to Tyler Cundiff, president, food & beverage group, Gray, Inc. “The last few years have been very active in the food and beverage industry, and we expect an even greater surge in capital spending activity within the global market looking ahead. Many factors contribute to this activity including manufacturing enterprise consolidation, an increased focus on food safety upgrades, innovative new processes and products as well as dynamic and growing global consumer demands. In addition, much of the current new project activity is a result of a drastic disruption to the global food supply and delivery system due to COVID-19.”

Navigating Design and Construction Today

Food processors see two areas where they need to invest if they want to manage the current economic conditions, says Pat Chisholm, executive vice president, BE&K Building Group. The first helps to define the processor’s role in environmental activities, and the second helps with reduced manpower.

According to Chisholm:

- Environmental, Social, and Governance (ESG)—“The food and beverage industry requires a considerable supply of energy and natural resources to do business, not only in fossil fuels, but also in terms of crops, soils, biomass, plastic, steel and minerals. As consumers become increasingly concerned about the sustainability of this industry, we are witnessing a huge shift in our clients considering ESG-related projects for their current and future facilities. Clients are beginning to consider upgrades that include solar panels, closed loop water systems, water treatment facilities, and more efficient packing solutions, among many others.”

- Automation—“As labor shortages continue to impact this industry, we are seeing clients increase automation in their processes to offset the need for qualified labor.”

Labor, however, affects AECs as well as food processors. “One unfortunate trend we see emerging currently is a lack of qualified tradesmen to perform the work on these projects,” says Dennis Whipple, electrical design build manager | electrical division, Shambaugh & Son, L.P. “We are experiencing an extreme shortage of electricians. Other trades are experiencing the same.”

In an effort to shorten design/build cycles, AECs are getting away from the design/bid/build strategy and are working toward an EPC (engineer/procure/construct) scenario, says Ed Gerken, PMP, LEED AP, senior project manager, SSOE Group. Clients are often resource constrained, especially regarding STEM degreed employees, and are looking to outsource project delivery to a greater extent.

“One of the biggest trends we continue to see are the advances being made in virtual design,” adds Nathan Arnold, director, client development, Hixson Architecture, Engineering & Process. “We’ve reached the point that today, many clients ask about the extent of BIM (building information modeling) capabilities for their projects.”

For certain, the past pandemic has made remote communications and virtual design practical. “Virtual design and construction (VDC) continues to be a growing execution of projects,” says Don Oberlies, vice president and market leader, Alberici Constructors. “Early contractor involvement is also growing in popularity as clients have fewer resources to dedicate to project development and need early input for cost and schedule certainty.”

Supply Chain Somewhat Improved—Unless it’s Electrical

Bad news: Does it have a microprocessor? Is it switchgear? Is it a transformer? Is it electrical or electronic in nature? Then, expect delays. Big delays—as long as a year.

“Highest risk in material availability remains in electrical and mechanical components,” says Alberici’s Oberlies. “We do not see a significant improvement in the next 12-18 months.”

Well, considering any product that is built with electrical and electronic components, this is literally the same story I got from at least 75% of the AEC firms participating in this article.

However, the good news is that the overall availability and lead time for most construction materials have improved considerably since the height of the pandemic—except for some select building materials, says Dan Crist, vice president, A M King. Material pricing has also started to stabilize since the pandemic.

How to cope? “Our focus is on expediting design packages related to long lead time items in order to maintain project schedule,” says Crist. “Identifying and providing alternate materials and manufacturers early in the design phase are critical.”

“While supply chain issues have not gone away, they seem to have normalized, or perhaps we are now better adept at working through these challenges and accepting when they occur,” says Black & Veatch’s Ziskind. “Still, there are opportunities to proactively mitigate potential supply chain issues on construction materials. For example, pre-purchasing certain materials with long lead times, such as switchgear, can be advantageous, and a construction firm who had these goods on hand or on order—or able to flex their schedule—has an advantage to better serve manufacturers.”

From a design standpoint, engineering labor, especially experienced, remains in demand, adds Ziskind. Flexibility continues to be important, not only from a facility operations standpoint but also availability of construction materials. Flexible designs can help address issues with material availability.

COVID-19 Spurred Growth of Distribution Centers

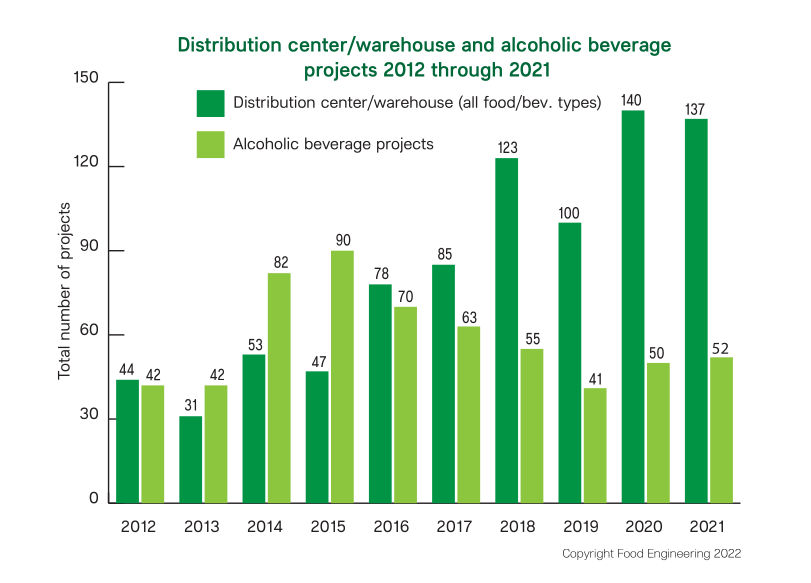

For the last couple of years, the FE Plant Construction Survey Tables showed a large increase in the number of distribution center (DC) construction (see “Distribution Center/Warehouse and Alcoholic Beverages 2012 through 2021”). “The supply chain challenges that impacted the food industry during COVID resulted in a significant increase in the demand for cold storage,” says CMC Design-Build’s Larose. “Concurrently, there was a sudden shift of real estate investment dollars into this segment, which further fueled the number of projects.”

“The extraordinary number of large distribution centers and cold storage facilities that came online in 2021 was unlike anything we have seen in recent years,” says BE&K’s Chisholm. “Not only were there many new projects, but the average size of these facilities also experienced a significant increase.”

According to Chisholm, these increases can be attributed to the impact of COVID-19 on:

- Food chain supply—There was an obvious increase in new projects to help shore up the supply chain due to global supply interruptions.

- Consumer purchase behavior—As a result of the pandemic, the home grocery delivery market exploded. As a result, there was an increased need for large distribution and cold storage facilities closer to the consumers they served.

“Now we are seeing a pause among food and beverage clients for the immediate future,” says Chisholm. “While these projects will eventually be built, we believe the market experienced over-construction because of the pandemic and now demand is waning. Current projects that are underway tend to be smaller in scope.”

Will DCs continue to see growth? If my experience is like most consumers, I’m willing to bet that home delivery is an option that is here to stay and pays for itself—even with the $7.95 delivery charge my grocery chain charges. Coming directly from the warehouse, produce is fresher—not picked over—and the two hours not spent in the store trying to find all the items on my list is worth the delivery charge.

“We continue to see growth in the direct-to-consumer market,” says Food Plant Engineering’s Redmond. “During the pandemic, a shift occurred in e-commerce as businesses pivoted to serve their customers. This continues, so we have seen our clients accommodate this need by adding or expanding distribution centers.”

“I believe that with the overall need for cold storage space in the industry, there is still more to come, but with the money getting more expensive to borrow and more difficult to get, we could see that cool off some,” says Tippmann.

Continued reshoring and onshoring will help keep DCs moving product. “During the pandemic, consumers experienced shortages—or perceived shortages—of key grocery, pharmaceuticals, and household items,” says Greg Verhoff, LEED AP, business leader, SSOE Group. “This raised awareness regarding the level of U.S. dependence upon global supply chains, which can be subject to issues well outside of our control. Combined with the significant increase of online purchasing, it led to the repatriation of production capacity back to North America and increased demand for distribution centers. Ongoing geopolitical tensions are very likely to continue driving the repatriation trend, especially in key markets such as semiconductors and pharmaceuticals.”

Greenfield or Brownfield?

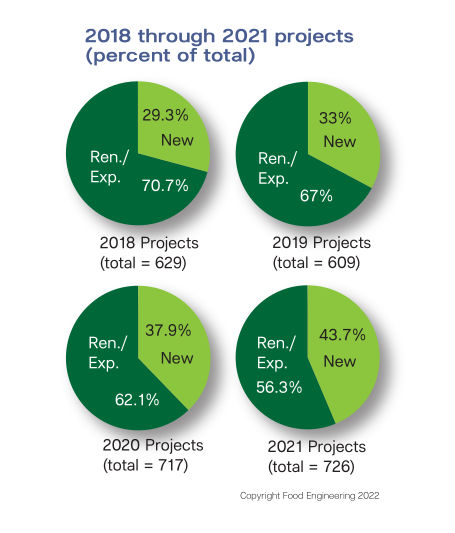

During the last few years of the FE survey, the number of greenfield (new) sites increased compared to reworking older sites (brownfield) (see “2018 through 2021 Projects (Percent of Total”). A big reason in the immediate past was that several existing and brownfield sites really didn’t make it easy to conform to FSMA requirements. Today, there are several reasons for greenfield sites.

“Greenfield builds are popular, as owners can control just about every aspect of the final facility,” says Black & Veatch’s Ziskind. “They provide maximum flexibility to meet current and future requirements. In short, greenfield sites can be truly purpose-built. Greenfield builds also offer opportunities to address more sustainable operations by building in such features/infrastructure. Greenfield facilities may require less maintenance. The scale, process, infrastructure needs and schedule can all weigh into the greenfield vs. brownfield approach. Having ‘shovel ready’ sites, such as those in food parks where infrastructure is readily available, can help manufacturers move quickly in a greenfield scenario.”

As new food products are developed and commercialized, greenfield sites may offer more flexibility as opposed to trying to fit a new process into an existing facility designed for a different purpose, adds Ziskind.

“Many factors contribute to the decision of greenfield or brownfield,” says Gray’s Cundiff. “Given a range of projects covering greenfield and brownfield sites, we see that objectives can be achieved with either option as long as the tradeoffs are understood very early in the planning process. Speed to market, design flexibility and capital cost always seem to be at the forefront of discussions when considering brownfield versus greenfield.”

Indeed, costs and trying to shoehorn processes and food safety into an old facility may not be practical. “With costs just as high—or sometimes higher—to retrofit a facility, it has made increasingly more sense for our clients to build new than to purchase older facilities,” says Hixson’s Arnold. “One driver: It’s easier to build a greenfield facility to meet modern hygienic food safety standards than to renovate an existing building to meet those standards. In addition, population shifts over time have led clients to choose to build operations around the available workforce.”

Food Safety and Security

FDA’s FSMA came into being in 2011, and AEC firms are up to speed on designing structures that comply. As Chisholm points out, many FSMA hygienic requirements are very similar to what has been engineered into pharma facilities for years. Some of these include locations for gowning, handwashing and applying PPE at the entrance to facilities. Cleanable surfaces, such as resinous floors, make cleaning easier.

Track and trace technologies, for the most part, have been well implemented, and new technologies that allow for continual sampling of certain pathogens as opposed to manual, scheduled swabbing provide earlier notification of potential contamination, says Ziskind.

CRB’s Moses sees an increased awareness and investment in food safety and security. Traceability is well established, needing fewer changes, but more emphasis has been put into cleaning and hygienic practices such that even smaller operations are looking at captive shoe programs and uniforms.

“We have experienced a steady workload related to facility renovations and site improvements involving enhanced plant sanitation and security,” says Telly Davis, SSOE Group senior project manager. Examples include site access control upgrades, hardening building perimeter entrances, data/fire/security system (DFS) upgrades, building automation system (BAS) upgrades, water quality improvements, and expanded clean-in-place (CIP) capabilities.

Alternative Proteins

While the total alternative protein market is projected at a growth rate (CAGR) of 12.4% from 2022-2029, reaching a dollar value of $36.61 billion in 2029, according to Research and Markets (R&M), AEC firms are a little more skeptical—or should we say realistic? The R&M study includes all types of alternative proteins (plants, insects, microbial) in human and animal food—except lab-cultured meats. Another optimistic R&M study entitled, “Lab-grown Meat Market by Type, Distribution Channel, Application - Global Forecast to 2035,” shows an expected CAGR of 24.1% from 2025 to 2035, reaching a value of $1.99 billion by 2035.

“Despite widespread media fanfare regarding alternative proteins, there seems to be a great deal of skepticism and outright resistance among consumers,” says SSOE’s Vetter. “Our firm has not seen much capital investment by clients in projects for the increased use of alternative proteins. In the near term, this appears to remain a fringe element of the market.”

“As hot as this market was in 2021 and 2022, we’re seeing a flattening at the present time,” says BE&K’s Chisholm. “Many of the firms in this sector are startups facing multiple current challenges. The first is the obvious financial climate where funding and loan availability have slowed. This is nearly identical to what we are seeing with startups and first-time manufacturers in the pharmaceutical and biotech industry. Second, consumer pricing for alternative proteins tends to be higher than that for traditional proteins. When Americans are already concerned with the recent rise in grocery prices, non-essential costs are the first to go. Third, there remain challenges with the taste and texture of these products that need to be resolved to produce the desired mass appeal. We do not see alternative proteins going away, but we do see a pause until the financial climate improves.”

“The alternative protein market is losing ground but will continue to be a player for those who want the option,” says Andrew Nelson, ESI Group USA VP business development. “The traditional packers have dipped their toes in this world, but don’t see a threat to the traditional model. The only difference in plant operations is the equipment used to process the plant-based materials.”

“There’s been tremendous change for alternative proteins over the last year, driven by a need to be commercially successful, as well as sustainable,” says CRB’s Moses. For facilities, this has had several impacts. Manufacturers are looking to “right size” their investments, being strategic about the types of capabilities needed. They’re also considering production more at suppliers or contract manufacturers. The types of line equipment may also change toward more bulk handling and packaging capabilities.

Sustainability and looking for opportunities to “upcycle” a waste stream that would otherwise have a cost or environmental impact to dispose of is a key issue when considering alternative protein production, adds Ziskind.

In general, facilities that process alternative proteins can have more complex designs from the perspective of allergen separation, HVAC controls, etc. Alternative proteins are usually more heavily processed, and their production is more complex than conventional proteins, adds Hixson’s Arnold.

Automation: Use It or Lose Out

With all the problem issues we just discussed, automation is a must for survival today. “Most of our clients are focused on implementing different degrees of automation and for many, it’s at the forefront of their growth plans,” says A M King’s Sawicki. These companies realize the need to do more with fewer employees and continue to invest heavily in the automation of their facilities. Clients that have historically invested in automation have seen effective ROI but those that lack experience with it are slow to move forward, Sawicki adds.

“We see an increase in automation in processing, packaging and warehousing/logistics due to hiring challenges and retaining team members,” says Gleeson’s Rens. Though these facilities take longer to build, there is an increase in storage, shipping and packaging automation, adds Rens.

“We are seeing much smaller operations looking into automation than in past years,” says CMC’s Larose. “Previously, it was unusual to see automation in small to mid-sized facilities but reduced labor availability combined with increased wages has made investments in automation attractive to a broader audience.”

“Automation continues to gain momentum,” says Moses. “Issues with labor availability are present throughout facilities, not just for repetitive or routine tasks, so there are opportunities now in every department. We’re seeing original equipment manufacturers (OEMs) look for ways to help companies automate maintenance, like remote monitoring for issues and sending technicians to perform preventative maintenance.”

And automation is not just for the plant floor. “Warehousing, whether it be work in process or finished goods, is where we see immediate need and payback,” says Mark Livesay, VP of automated warehousing at ESI Group USA. Customers are seeing a three-to-five-year payback on AS/RS rack supported warehouses, both ambient and frozen. Increased production requires increased warehouse capacity and with labor shortages and land utilization issues, a rack-supported AS/RS (approximately 110 ft. tall) utilizes one-third the area of a conventional warehouse.

For more on automation, see “Automation Considerations In Case Packing and Palletizing” and “Designing and Coordinating Packaging Automation for Variety Packs.”