Costs, Knowledge Gaps and Skill Deficiencies Hinder Digital Transformation

Most food processors know the advantages of digital technologies, but implementation remains a challenge.

With today’s heavily instrumented food plants looking more like a modern chemical plant, everyone from the plant floor to the enterprise need to be tuned into data that provides an accurate window to the process — past, present and future. Image courtesy of Imagemakers.

The CML18 Liquiline Mobile platform with the Memobase Pro Bluetooth mobile app empowers technicians with easier calibration, maintenance, and documentation of their workflows, helping bridge the gap between the field and the lab. Image courtesy of Endress+Hauser USA.

Todd Gilliam, Rockwell Automation Americas

Todd Gilliam, Rockwell Automation AmericasWhile digital transformation and smart manufacturing hold promise for CPG/food and beverage processors to keep pace with market changes and improve efficiencies, the industry lags in the use of technology due to adoption costs, a lack of knowledge and a shortage of skills within many food operations.

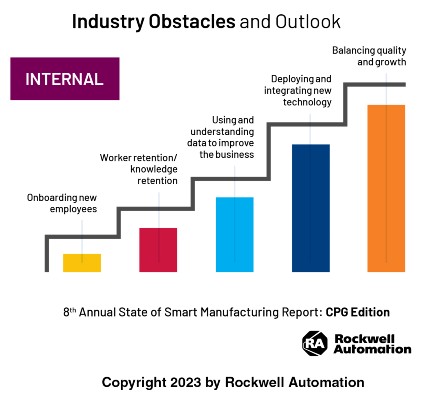

According to a report titled, “Rockwell Automation 2023 Manufacturing Report: CPG Edition,” 78% of CPG manufacturers believe smart manufacturing is very important to the future success of their business, yet 36% of respondents believe that the deployment of technology and the use of data represent significant internal challenges.

Despite ROI and success stories, smart manufacturing — including automation — face adoption hurdles in the CPG industry, says Todd Gilliam, Rockwell Automation Americas industry manager for CPG. “The ‘2023 State of Smart Manufacturing report CPG edition,’ found the main culprit to be cost (44%), followed by knowledge gaps (41%) and skill deficiencies (39%). However, interest remains high, suggesting an opportunity for modular solutions offering lower upfront costs, faster benefits and clear ROI.”

But the concepts of smart manufacturing are still relatively unfamiliar to food processors. The report found that while 48% of home and personal care leaders in the CPG group say they are extremely familiar with smart manufacturing, which is well above the global average, only 23% of food and beverage companies say the same.

CPG manufacturers identified balancing profitable growth and quality as their biggest internal obstacle in 2023, followed by deploying and integrating new technology and using and understanding data to improve the business. Graph courtesy of Rockwell Automation.

Jason Pennington, Endress + Hauser USA to work through with customers in the CPG industries for adopting digital technologies are:

Jason Pennington, Endress + Hauser USA to work through with customers in the CPG industries for adopting digital technologies are:- Aligning value with cost benefits while augmenting what is already in place. This is an industry heavy on third-party OEM systems and a higher quantity of locations that have their own systems, so architecting something around packaging, filling and cleaning systems that came from different companies might look and feel a little different compared to a chemical or O&G (oil & gas) facility that’s holistically built for purpose, or is part of a high volume, fewer-locations philosophy with integrated control systems and consoles.

- Simplicity and usability that considers work force availability and on-boarding. We’ve seen some digital platforms work well in industries with seemingly transferrable benefits to CPG. However, CPG has a pattern of managing acquired assets and brands, varietal IT and OT infrastructure depending on the type of plant, and a much higher focus on digitalization in distribution and branding than manufacturing or maintenance.

- Although CPG tends to be a slower but stable growth industry, it really is an industry to admire based on its ability to adapt and fulfill consumer demand and preferences. I’m always amazed to visit CPG facilities and see how quickly brands or brand extensions can be brought to market at scale, compared to facilities in other industries that are built for purpose with a 30-plus year payback of future cash flows considered in the business case. Consequently, these dynamics represent challenges or opportunities when it comes to continuous improvement through digitalization.”

Balancing Quality/Food Safety with Profitable Growth

“Food and beverage processors navigate the tightrope between quality/food safety and profitable growth through rigorous standards, automation, data-driven approaches and resource optimization,” says Rockwell’s Gilliam. “Technologies like IoT sensors, big data analytics and AI help them optimize processes, predict issues and personalize marketing, all while ensuring transparency and safety. While challenges exist, these advancements can help processors achieve significant efficiency gains, reduced waste and enhanced brand reputation, ultimately driving profitable growth.”

A few examples of tools that CPG companies are selecting to balance growth, food safety and quality include real-time vision quality inspection, batch performance analytics for comparison to “golden batch” quality such as the Plex cloud/SaaS Quality Module and the ASEM Optix HMI panels. On the hardware side, companies use hygienic-compliant materials like stainless steel, Gilliam says.

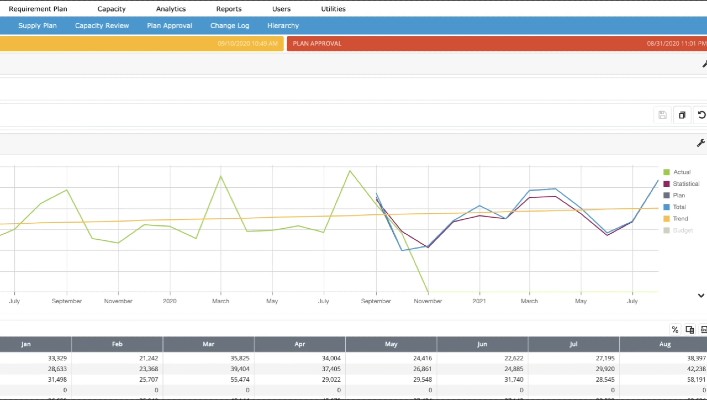

Plex’s DemandCaster SCP applies machine learning (ML) technology to historic inventory and procurement data to provide insights surrounding optimal inventory procurement strategies based on context. Screen courtesy of Plex

“Quality and safety are topics that are very transferable independent of acquisitions, SKU changes or brand extensions,” says E+H’s Pennington. “We have seen several growth product categories for CPG over the last couple of years, particularly in the general categories of multi-variable devices and lab enablement. We’ve especially focused on bridging the gap between the field and the lab.”

“To make this possible, we launched the Liquiline Mobile platform (CML18) for our Memosens series of analytical sensors,” Pennington says. “This platform leverages our new Memobase Pro mobile app and Bluetooth connectivity to help technicians calibrate, maintain, and document their workflows with an easy to use, menu-driven workflow in their hand, anytime and anywhere.”

Jim Bresler, Plex

Jim Bresler, PlexFine tuning MES and ERP systems toward the needs of the food industry have helped processors begin with a system already geared toward food, rather than having to adapt a system designed for other industries. “Plex’s manufacturing execution system (MES) is designed to benefit food and beverage processors by modeling yield losses in detail and providing timely, detailed reporting of material usage/yield, labor efficiency and total production cost,” says Jim Bresler, Plex director of product management.

While compatibility issues may exist between quality management systems (QMS) and ERP systems with MES, one solution may be to obtain all three systems from the same vendor. This is possible with Plex QMS, MES and ERP, with all three fine-tuned for food and beverage needs. Other suppliers provide comparable systems and can be located with a little research.

New Technology and Existing Staff

In the Rockwell study, CPG/food processors said deploying and integrating new technology was their second biggest internal issue (including technically proficient staff) — next to balancing quality and profitable growth. How are these technology tools easier and less expensive to implement? What’s in future technology offerings that could further ease the adoption/implementation process?

According to Rockwell’s Gilliam, the study says 55% of CPG manufacturers are now embracing smart manufacturing, focusing on quality, production and resource planning — yet 30% of accumulated data still goes unused. “Technology tools are breaking down barriers to adoption in two key ways: cost reduction and ease of use,” Gilliam says. “Cloud platforms and subscription-based software offer pay-as-you-go options, eliminating hefty upfront costs. Additionally, pre-built tools and modules simplify implementation, requiring less customization and technical expertise.”

Looking forward, Gilliam says CPG companies are leveraging the following technologies to ease adoption and implementation:

- Digital twin and emulation technologies to design, test and simulate what-if scenarios and resource requirements ahead of new line and plant commissions.

- Augmented reality (AR) and virtual reality (VR) technologies that can be for digital work instructions, knowledge capture and remote access for OEM and system integration partners, empowering workers to streamline troubleshooting and maintenance.

- Edge computing and edge-to-cloud integration for low-latency, high-speed mobility use cases and AI/ML high-volume comparisons — as well as private 5G infrastructure for the same use cases.

- Wireless IIoT sensing for low-cost, rapid deployment assets and instrumentation.

- “Unified robotic control” for streamlining multiple types and formats of control, motion and automation.

- Cloud-based, computerized maintenance management systems (CMMS) for predictive/prescriptive maintenance approaches to anticipate and plan for disruption and downtime events.

“One of the greatest advantages of software today is the value of cloud-based software,” says Plex’s Bresler. “This eliminates the need for on-premise infrastructure and reduces upfront costs and ongoing maintenance burdens. Similarly, modular architecture keeps costs down by allowing food and beverage processors to choose which functionalities are necessary to their operations and avoid paying for additional non-essential features.”

Besides cloud-based and modular software, Bresler emphasizes that today’s software should prioritize configuration over customization. This provides users with a version-less software that is continuously updated, allowing food and beverage processors to meet varying business needs.

In the future, the food and beverage industry can expect an increase in the use of AI, Bresler says. “Plex is actively developing and implementing AI-driven tools for predictive maintenance, process optimization and error detection.”

Large Multinationals Embrace Digital Transformation

While smaller and medium-sized companies are incrementally adding digital transformation capabilities, large multinational companies have embraced the technology out of sheer necessity. Nestlé was listed No. 8 out of 25 companies in ARC Advisory Group’s “ARC Special Report, January 2023” for the “Industrial Digital Transformation Top 25 for 2022.” Other CPG companies making the Top 25 included Unilever, 3M and Procter & Gamble.

Nestlé has operations in 191 countries with a portfolio of more than 2,000 brands. Digitalization covers all aspects of the company’s business from internal organization to external engagements. The IT department has been instrumental in delivering value to the business as opposed to just providing IT systems and services. Digital transformation is about business outcomes —increasing capacity, decreasing costs and increasing innovation and product availability.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!