Site Locations

Key issues in locating food manufacturing sites

Based on FE’s 45th Annual Plant Construction Survey, two hot button site location topics are availability of labor and a reliable supply chain

Swiss technology group Bühler and Ardent Mills, a Denver-based flour milling and ingredient company, celebrated the opening of Ardent Mills’ new Port Redwing Mill in Gibsonton, Florida. The mill, powered by advanced milling technologies from Bühler, is already in operation. Photo courtesy Bühler and Ardent Mills

Just as we made the resounding case for automation in the article, “Automation and food processing today: It’s about labor“ architectural & engineering/construction firms (A&E/Cs) see labor as not only an issue for their own staffs, but more important as a major influence on where food and beverage processors are locating plants. And if you look at what was reported to be the second most important concern in locating a facility, it would be close to reliable logistics—and of course, supply chain reliability has been a major problem for the last couple of years—due again to primarily labor shortages.

While the U.S. government Bureau of Labor Statistics (BLS) and the news media happily reported the low national unemployment rate of 3.6% in April 2022, the number is misleading. Why? While labor statistics look good at the time of this writing, according to the U.S. Chamber of Commerce, 47 million workers quit their jobs in 2021—known as “The Great Resignation.” [1] Many people are off the record, after having been unemployed for a period of time that they are no longer tracked.

In fact, according to BLS, while payroll employment was up by 428,000 in April 2022, it was down by 1.2 million since February 2020. Total nonfarm payroll employment rose by 428,000 in April 2022. Nonfarm employment in April was still 1.2 million below its pre-pandemic level in February 2020. In April 2022, employment in leisure and hospitality increased by 78,000 and is down by 1.4 million since February 2020. Manufacturing added 55,000 jobs in April. Since February 2020, manufacturing employment is down by 56,000. [2]

Location, location, location…by labor availability

Dan Crist, A M King, vice president sums up pretty much what I noted above by saying, “Labor shortages are continuing to be a major influencer in dictating where a facility will be located. Food and beverage clients are increasingly concerned with finding qualified labor to operate their new facilities. With the continued rising costs of fuel and lack of truck drivers, our clients are showing increased focus on transportation and logistics when selecting a site.”

The South being a good region to locate, PepsiCo Beverages North America is expanding its Tucker, Ga., soft drink facility with a $260 million investment, increasing the plant’s size by 260,000 sq.-ft., which is expected to increase production capacity by five times by 2025. Photo courtesy of PepsiCo Beverages NA

The South being a good region to locate, PepsiCo Beverages North America is expanding its Tucker, Ga., soft drink facility with a $260 million investment, increasing the plant’s size by 260,000 sq.-ft., which is expected to increase production capacity by five times by 2025. Photo courtesy of PepsiCo Beverages NA

Indicative of location, Greg Franzen, Faithful+Gould program director, agrifood, says “The Southeast U.S. seems to be the continued favorite among greenfield plant projects due to more favorable labor pool, tax incentives and business climate, though of course, there is plenty of development in the south and southwest.”

According to BLS statistics as reported by World Population Review, South Carolina has the highest employment rate of 97.70% and is tied with Utah and Vermont with the same rates. Virginia has an employment rate of 97.40%, and Alabama reports a rate of 97.30%. In Florida the employment rate is 97.0%.

One might ask whether it might be better to locate in a state with lower employment figures as it would seem that more people are available to work. For example, states with the lowest employment figures are besides Alaska at 93.90%; Mississippi at 94.30%; West Virginia, 95.00%; Louisiana, 95.10%; New Mexico, 95.30%; Arizona, 95.40% and Pennsylvania, 95.50%.

Arizona has had a population upsurge, and food and beverage companies are finding the state a good place to locate, especially for distribution to the Southwest and the West Coast. Nestlé USA announced a $675 million investment to build a new beverage facility in Glendale, Ariz. Nestlé’s investment strengthens its market position and enhances its manufacturing capabilities to meet increased consumer demand for its products. Photo courtesy of Nestlé

Arizona has had a population upsurge, and food and beverage companies are finding the state a good place to locate, especially for distribution to the Southwest and the West Coast. Nestlé USA announced a $675 million investment to build a new beverage facility in Glendale, Ariz. Nestlé’s investment strengthens its market position and enhances its manufacturing capabilities to meet increased consumer demand for its products. Photo courtesy of Nestlé

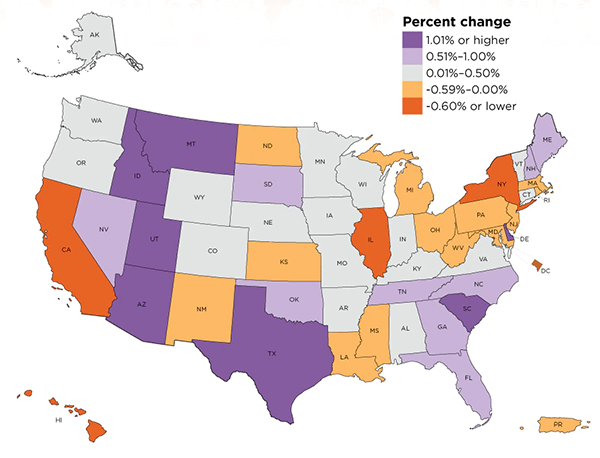

Perhaps more telling, are the states that have had the highest level of incoming migration from the period of July 1, 2020 through July 1, 2021—these numbers measured per 1,000 inhabitants, according to the Census. Florida saw the highest at 10.14 (total of 220,890) followed by Texas at 5.77 (a total number of 170,307), and Arizona with 93,025 new inhabitants. North Carolina, South Carolina, Tennessee and Georgia all saw more than 50,000 people move in. Three big loser states include California with 367,299 people moving out; New York losing 352,185; and Illinois subtracting 122,460 people.

Population change for states (and Puerto Rico) from July 2020 to July 2021 shows three states losing the greatest numbers of people to be California, New York, and Illinois. South Carolina, Texas, Arizona and others had influxes of people with population changes of 1.01% or higher. Source: U.S. Census Bureau

Population change for states (and Puerto Rico) from July 2020 to July 2021 shows three states losing the greatest numbers of people to be California, New York, and Illinois. South Carolina, Texas, Arizona and others had influxes of people with population changes of 1.01% or higher. Source: U.S. Census Bureau

Labor availability no matter the cost

Well, within reason, that is. In some areas, “labor availability,” (more than labor cost) is a key factor in finding a site, according to David Ziskind, Black & Veatch NextGen Ag director of engineering. Ziskind would argue that in the past taxes and business climate would have been major draw factors, but these incentives have fallen in terms of importance. Labor availability with supporting logistics (with adequate labor) are key issues processors can’t function without.

The size of the local labor pool has always been a factor in site selection, however, it has become the key factor for many projects over the past two years,” says Nate Larose, director of project development, CMC Design-Build. “And with the proliferation of massive internet retailer DCs around the country that hire thousands of employees, the competition for labor is another aspect of the labor pool that has become a key metric during site selection.

Can labor availability make or break a deal? You bet! Jeff Jendryk, VP, business development at Spec Engineering, A Gray Company, recounts a situation. “One major influencer of site location is labor availability, which is becoming difficult with the current housing market. For instance, one of our customers was building out a facility that needed 400 contract workers. With their planned expansion, they would need an additional 200 workers to optimize the expansion. With no hope of attracting workers to the current area due to housing prices and taxes, the company decided to move their distribution facility because of the availability of infrastructure, labor, and lower costs.”

Reliability, stability: That’s what processors want in a site

“Reliability is a big trend in site selection,” says Dan McCreary, Dennis Group senior partner. “Food processors don’t want a lot of uncertainty or unpredictability. They are seeking a stable workforce, reliable utility and transit infrastructure, and predictable local government regulations. In the same vein as reliability, the pandemic has created a desire for clients to be physically located in closer proximity to both raw materials and distribution centers. Supply chain disruptions and resource scarcity can severely impact profitability, and manufacturers are starting to favor greater stability even if it’s at the expense of slightly higher operating costs.”

Availability of labor, friendly business climate, close proximity to consumers, ingredients and distribution channels, and regional incentives—all these heavily influence food and beverage manufacturers in determining the location of their next operation, says Tyler Cundiff, president, Gray, Inc., Food & Beverage Group. “The need for efficiency and speed of transport to support increased food and beverage e-commerce trends is having a dramatic effect on distribution centers and the use of automation (e.g., robotics) along the supply chain, resulting in a further site selection consideration for processors.”

While Ziskind says that incentives have lost some of their glitter, that doesn’t mean they still aren’t a variable in the ideal site parameters = purchase equation. McCreary notes, “In recent years, we have been able to leverage the promise of bringing new high-paying jobs to an area in exchange for sizeable regional and state incentives, which can offset 10% or more of the cost of constructing a new facility.”

Jendryk adds, “Another [processor] recently moved their facility to another state because of a better tax and business climate. Cities are starting to give tax incentives again to attract businesses. Supply chain also has an effect on the site location choices, as trucking availability can play a large role, along with being near major interstates and markets, along with having adequate power supply.”

“Supply chain has always been a major influence on site selection and continues to be now,” says Chris Jarc, P.E., vice president, and manager, project management, Hixson Architecture & Engineering. “The process most of our clients have taken is to first decide what part of the country will be best for them. They then narrow the field by looking at supply chain, logistics, and labor availability, then what incentives are available. It’s a pretty classic model.”

Logistics, a thorn in the side: Plan to have backup shippers/suppliers

“Logistics is becoming a bigger challenge in the industry as we look at higher shipping costs and a driver shortage in the trucking industry,” says Jason Robertson, CRB VP, food and beverage. “Costs of production and labor availability are other factors impacting site locations. Many projects are moving toward the central states and away from higher labor costs you see on the west and east coasts.”

Food and beverage processing companies are highly concerned with logistics for good reason. “The receipt of raw product, packaging materials and distribution of goods for consumption are critical to meeting forecasted revenue goals,” says Courtney Dunbar, site selection and economic development director at Burns & McDonnell. “Weather interruptions, particularly on a large scale and regional in nature, threaten the precision of the supply chain and can ultimately lead to delays in receipt of shipment of goods.”

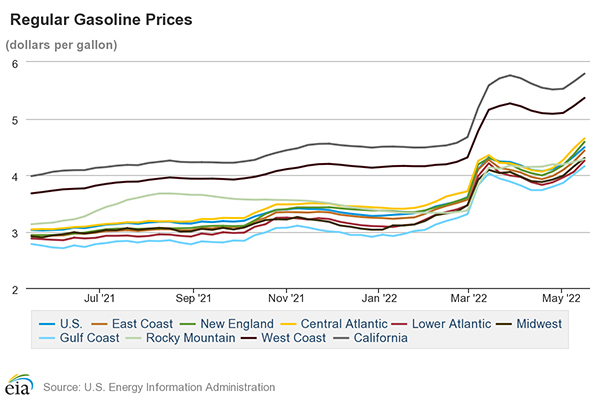

The cost of gas has risen since the Biden administration took over in 2021, increasing shipping costs in the supply chain. Not shown here, Diesel fuel costs have risen in a similar fashion, often tracking a dollar or more (depending on state taxes) than gas per gallon. Source: U.S. Energy Information Administration.

The cost of gas has risen since the Biden administration took over in 2021, increasing shipping costs in the supply chain. Not shown here, Diesel fuel costs have risen in a similar fashion, often tracking a dollar or more (depending on state taxes) than gas per gallon. Source: U.S. Energy Information Administration.

Food processors have worked to identify backup distribution channels in the event of widespread interruptions to their supply chain, adds Dunbar. Many rely on multiple modes of transportation for the receipt and shipment of goods and have identified additional suppliers to thwart interruptions that might be caused by too heavy of reliance on one supplier.

Drastically changing consumer purchasing patterns have put stress on processors and the supply chain in the last five years. Consumers have come to expect immediate product deliveries, says Dunbar. This has placed additional pressures on processors to identify solutions and backup methods for on-time receipt of raw product and delivery of finished goods.

“Primarily influenced by the disruption of the pandemic, supply chain disruptions have caused many processors to re-think the proximity to raw materials and inbound and outbound trucking availability to reduce the time and costs associated with procuring ingredients,” says Rick Elyar, Haskell Company director — business development. “In the end, site selection decisions come down to each food processor’s highly unique site requirements and the specific time to market requirements for their products.”

While Andrew Nelson, regional manager at ESI Group USA, hasn’t seen supply chain as necessarily having an effect on site location, he notes there are challenges throughout the entire chain. “In the Midwest, I’d say a trend of staying out of major core metro areas is still the prevailing factor as long as there are solid truck routes available.” (June’s Manufacturing News reported in more depth on this subject.) Away from major metro issues, sites have more room to breathe, usually with lower taxes and fees.

Other important site issues: site availability and utilities

While we’ve looked extensively at labor availability and logistics, other important site issues remain important. For example, Ziskind says availability has become the dominating factor in site location. “For manufacturers who are looking to scale rapidly, a ‘shovel-ready’ site with utilities in place or with significant capacity, is highly valued. Brownfield sites, even those buildings which previously might not have been highly desirable for food production, are being pursued rapidly with manufacturers making the decision to improve and retrofit these facilities when they offer a schedule advantage.”

For manufacturers who have upstream or downstream “offtake arrangements,” there has been interest in co-locating facilities to minimize logistics/transportation availability issues, cost, and impact, adds Ziskind. While taxes and business climate, including local government incentives, are important, these seem to have fallen in terms of importance. Local governments may see an advantage in providing initial development of sites, making utilities available, and streamlining the zoning and permitting process over strictly providing financial incentives, adds Ziskind.

As it pertains to site selection for new facility growth, weather and incidences of natural disasters remain in the forefront for investigation in a site search, says Dunbar. Areas with less potential impact for process interruptions and closer proximity to raw product and/or identified consumers fare better for development consideration. As most food and beverage processing companies are highly reliant on higher-than-average water capacities and quality as well as electric capacities and reliability, areas that can prove uninterruptable service availability to support operations are more desirable for locating new or expanded operations.

Besides utility and potable water availability, sites that have space for wastewater treatment are becoming more common. “We are seeing an increase in wastewater pre-treatment plants privately owned and operated by food processors,” says Mark Galbraith, co-owner of Galbraith Pre-Design. “They are being required by municipalities to treat their process waste more and more.”

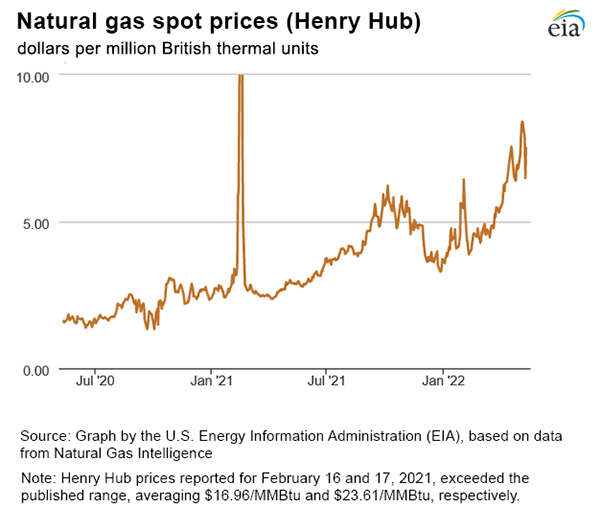

During the previous administration, energy costs remained relatively low. But with the price of gas increasing more than $1.50 and Diesel fuel as well—along with natural gas in the first two years of the Biden administration, the cost of energy matters. Natural gas, briefly reached $8.03 per MMBtu on April 18th before settling down again, according to the American Gas Association (AGA). In April 2022, AGA reports “prompt-month futures being consistently traded above $6.00, a 140% increase since April 2021.” But, natural gas is still a comparative bargain in the U.S. In Europe and Asian markets, natural gas contracts are regularly well above $30 per MMBtu, including $70 contracts following Russia’s invasion of Ukraine, according to AGA. U.S. prices are expected to decline in early 2023 as supply catches up to demand. [3]

So, rising energy costs should be factored into site locating considerations—but not just for fuel to run boilers. “While many of the food and beverage producers are looking for greenfield sites and are primarily focused on the availability of a large workforce, necessary infrastructure through an abundant supply of utilities, and competitive energy costs, we are seeing more processors strategically locating their new operations closer to their core ingredient sources,” says Haskell’s Elyar. Not only does this make the supply chain shorter and more reliable, it also reduces transportation energy costs.

A note of thanks

FE wishes to thank those A&E/C firms who have helped with the preparation of this article: A M King, Atkins North America (dba Faithful+Gould, Inc.), Black & Veatch NextGen Ag, Burns & McDonnell, CMC Design-Build, CRB, Dennis Group, ESI Group USA, Galbraith Pre-Design, Gray, Hixson Architecture & Engineering, Spec Engineering—A Gray Company and The Haskell Company.

References:

[1] “Understanding America’s Labor Shortage: The Most Impacted Industries,” U.S. Chamber of Commerce, Global Forum Day 2, accessed 17 May 2022; (https://www.uschamber.com/workforce/understanding-americas-labor-shortage-the-most-impacted-industries)

[2] “Payroll employment up by 428,000 in April 2022; down by 1.2 million since February 2020,” TED: The Economics Daily, May 10, 2022; accessed 17 May 2022; (https://www.bls.gov/opub/ted/2022/payroll-employment-up-by-428000-in-april-2022-down-by-1-2-million-since-february-2020.htm)

[3] “Why are natural gas prices on the rise?” (Updated on April 21, 2022), American Gas Association website, accessed 18 May, 2022. (https://www.aga.org/research/data/natural-gas-prices/?utm_source=Google&utm_medium=Search&utm_campaign=May2022&gclid=Cj0KCQjwspKUBhCvARIsAB2IYusHk1tdNMiewYBgbRd0ID6Pe08Rmo9Ca_7R05qaj3EtlgEedCBfLAsaAgvWEALw_wcB)

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!